The outside trade (Forex) advertise is the biggest and most fluid budgetary advertise in the world, with a day by day exchanging volume surpassing $6 trillion. For dealers, understanding Forex Market Trends patterns is fundamental for making educated choices and maximizing potential returns. In this article, we will investigate what Forex patterns are, how to recognize them, and the devices and methodologies that can offer assistance dealers remain ahead in this energetic market.

What Are Forex Market Trends?

A drift in the Forex advertise alludes to the common heading in which a money pair’s cost moves over a period. Patterns can be classified into three types:

Uptrend: When the cost reliably moves upward, shaping higher highs and higher lows.

Downtrend: When the cost reliably moves descending, shaping lower highs and lower lows.

Sideways or Range-bound Drift: When the cost wavers inside a characterized extend without a clear upward or descending direction.

Understanding the sort of slant is the foundation of making viable exchanging strategies.

The Significance of Slant Analysis

Trend examination makes a difference traders:

Identify beneficial section and exit focuses: By taking after the heading of a slant, dealers can adjust their positions with the winning showcase momentum.

Reduce exchanging dangers: Entering exchanges that go against the drift can lead to noteworthy losses.

Develop methodologies: Patterns give a system for specialized examination and offer assistance dealers utilize pointers more effectively.

How to Distinguish Forex Trends

There are a few ways to recognize Forex showcase patterns, including:

1. Price Activity Analysis

Observing the development of cash sets on a cost chart is one of the most direct ways to recognize patterns. Dealers see for designs like rising or plummeting channels to decide the slant direction.

2. Moving Averages

Moving midpoints (MA) are commonly utilized markers that smooth out cost information to appear the slant heading. The most well known sorts are the Straightforward Moving Normal (SMA) and the Exponential Moving Normal (EMA).

A cost over the moving normal shows an uptrend.

A cost underneath the moving normal recommends a downtrend.

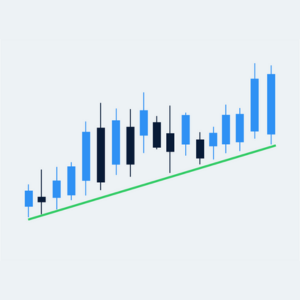

Trendlines

Drawing trendlines on a chart can offer assistance dealers visualize the drift. An upward trendline interfaces higher lows, whereas a descending trendline interfaces lower highs.

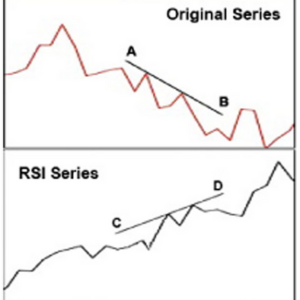

1. Relative Quality File (RSI)

RSI is a energy oscillator that shows whether a cash is overbought or oversold. It can affirm the quality of a slant or flag potential reversals.

2. Candlestick Patterns

Specific candlestick arrangements, such as bullish inundating or bearish immersing designs, can give understanding into slant inversions or continuations.

Tools for Analyzing Forex Trends

Modern dealers have get to to different devices and stages that help in drift analysis:

- MetaTrader 4/5 (MT4/MT5): Broadly utilized exchanging stages with built-in pointers for slant analysis.

- TradingView: A web-based stage that offers progressed charting apparatuses and community insights.

- Automated Exchanging Frameworks: Calculations and bots can be modified to distinguish patterns and execute exchanges automatically.

Strategies for Exchanging Forex Trends

Once a drift is recognized, dealers can utilize particular methodologies to capitalize on it:

1. Trend-following Strategy :

This includes entering a exchange in the course of the slant. For occasion, buying amid an uptrend and offering amid a downtrend.

2. Breakout Trading :

Breakout procedures center on entering exchanges when the cost breaks over resistance or underneath back levels, signaling the begin of a modern trend.

3. Pullback Strategy :

Traders hold up for a pullback inside the slant and enter when the cost resumes its unique direction.

4. Position Measuring and Chance Management :

Regardless of the procedure, overseeing chance through stop-loss orders and legitimate position measuring is basic to minimizing losses.

Challenges in Drift Analysis

While recognizing Forex showcase patterns is important, it is not without challenges:

- False Signals: Pointers can some of the time produce deluding signals, driving to losses.

- Market Instability: Sudden news occasions can disturb patterns and cause eccentric cost movements.

- Over-reliance on Instruments: Instruments and markers ought to complement, not supplant, a trader’s judgment.

Conclusion

Understanding Forex Market Trends advertise patterns is principal for any dealer pointing to succeed in the remote trade showcase. By combining specialized examination, dependable apparatuses, and sound methodologies, dealers can superior explore the complexities of Forex exchanging. Whereas challenges stay, ceaseless learning and restrained execution can make the distinction between victory and disappointment in this exceedingly competitive market.

Whether you’re a tenderfoot or an experienced dealer, remaining educated and versatile is key to acing Forex advertise patterns and accomplishing your monetary objectives.