In the ever-evolving landscape of financial markets, option trading stands out as a sophisticated and versatile strategy employed by investors to manage risk, speculate on market movements, and enhance overall portfolio performance. If you’re new to the world of trading, understanding what option trading entails is essential. Let’s embark on a comprehensive guide to demystify the intricacies of option trading.

Defining Option Trading

Option trading is a financial derivative that provides investors with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, within a specified time frame. This financial instrument derives its value from the underlying asset, which can range from stocks and commodities to indices and currencies.

Types of Options:

There are two main types of options: call options and put options.

Call Options: These give the holder the right to buy the underlying asset at the specified strike price before or at the expiration date.

Put Options: These grant the holder the right to sell the underlying asset at the agreed-upon strike price before or at the expiration date.

Key Components of Option Trading:

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiration Date: The date by which the option contract must be exercised or it becomes void.

- Premium: The price paid by the option buyer to the seller for the rights outlined in the contract.

- Underlying Asset: The actual financial instrument (e.g., stocks, commodities) on which the option contract is based.

Why Choose Option Trading?

- Risk Management: Options allow investors to hedge against potential losses in their existing investments, acting as a form of insurance.

- Speculation: Traders can capitalize on market movements without the need for significant capital by using options.

- Income Generation: Writing options (selling) can generate income, especially in stable or range-bound markets.

- Portfolio Diversification: Options provide an additional layer of diversity for investors looking to spread risk across various asset classes.

Basic Option Trading Strategies:

- Covered Call: Involves holding a long position in an asset while simultaneously selling a call option on the same asset.

- Protective Put: A strategy where an investor buys a put option to protect against a potential decline in the value of an underlying asset.

- Long Straddle: Involves buying both a call and a put option with the same strike price and expiration date, anticipating a significant price movement.

- Credit Spread: A strategy where an investor sells one option and buys another option with the same expiration date but a different strike price.

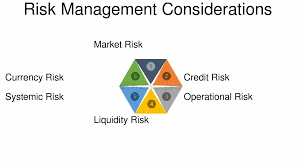

Risks and Considerations:

- Limited Timeframe: Options have expiration dates, and their value diminishes as the expiration date approaches.

- Potential Losses: While the potential gains can be significant, options trading also comes with the risk of losing the entire premium paid.

- Complexity: Options trading requires a solid understanding of financial markets and a grasp of various strategies, making it more complex than traditional stock trading.

Conclusion:

Option trading is a dynamic and powerful tool that provides investors with strategic alternatives to navigate the complexities of financial markets. While it offers the potential for enhanced returns and risk management, it requires a comprehensive understanding of its mechanisms and associated risks. As with any financial instrument, individuals venturing into option trading should conduct thorough research, consider their risk tolerance, and possibly seek guidance from financial professionals. With knowledge and prudence, option trading can be a valuable addition to an investor’s toolkit, unlocking a world of strategic possibilities in the financial realm.